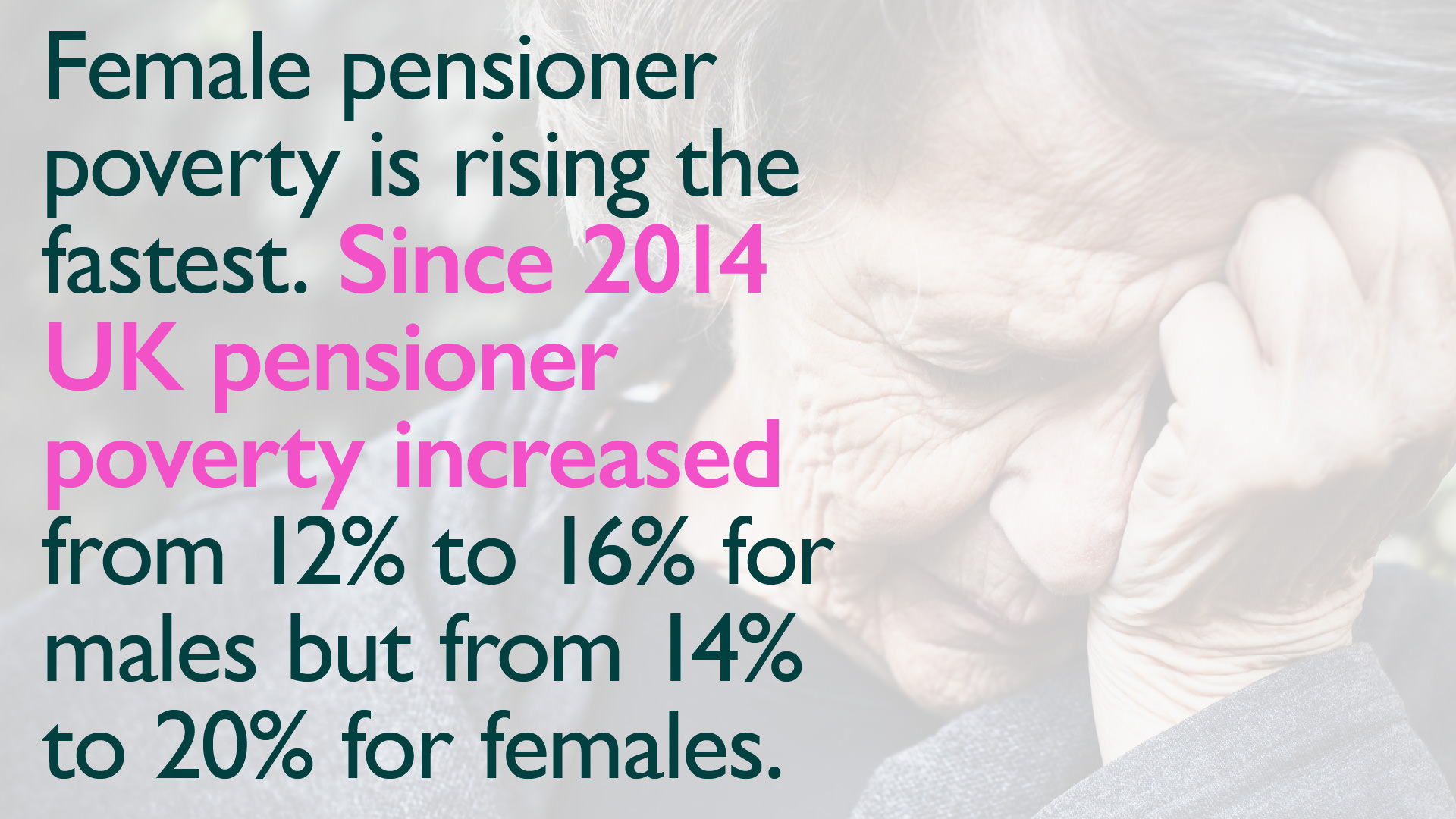

Wealthy nations shouldn’t have poor pensioners

The UK’s basic weekly state pension of £156.20 is one of the worst in the developed world and worth only 16.7% of pre-retirement wages. Poorer pensioners can claim means-tested benefits to get £201.05 but that is still not enough to live on. We need a Wellbeing Pension of £235.00 per week – the amount required to cover the basic cost of living and escape poverty. The UK basic state pension plus benefits is £27.44 per week lower than pensioners need to live with basic dignity and that is unacceptable.

The Affordability of the Wellbeing Pension

If you are asking the question – can the UK Government really afford to pay the Wellbeing Pension? Then you are already accepting the idea that creating a society where pensioners can afford to live with dignity is optional and not a necessity.

Let’s be clear – paying a lower pension than almost every other country in the developed world is a policy decision made by UK governments of left and right. Pensioner poverty is a choice made by successive Chancellors, whose shared goal has been to boost the City of London, by forcing the wealthy to purchase private pensions.

Spending £108 billion on HS2 whilst paying an inferior pension, or planning to spend £205 billion renewing Trident whilst breaking the triple-lock on pensions in the face of the worst cost of living crises in generations is a policy decision.

We are living in an upside-down world if these and dozens of other spending decisions the UK Government makes come first and pensioners’ needs come last. We believe that to build a thriving society, you must first take care of core payments such as funding decent pensions, a functioning NHS, appropriate policing and education etc. Then, if the Government thinks it has nothing left and doesn’t want to borrow more then what it cannot afford to pay for is those expensive and totally unnecessary projects.

Even so, we can afford the Wellbeing Pension without extra borrowing or raising taxes – here are four reasons why!

National Insurance Revenues Are In Surplus.

Pensions are paid out of National Insurance Contributions (NICs) from working people. The UK Government’s Office for Budget Responsibility has forecast that NICs will be worth £172 billion in 2022/23.

Current Pensions Costs are £123 billion

The current cost of the State Pension system to the UK Government is £123 billion a year.

So there is a surplus of £49 billion. Remember that the UK Chancellor increased NIC payments in April 2022 by 1.25 percentage points, just as he broke previous manifesto promises to raise pensions by up to £487.00 per year. So the Government is planning to use the NIC surpluses to raise pensions just before the next General Election – we say: pensioners need the money now due to the cost of living crises and that UK Chancellors should stop playing political games with pensioner wellbeing.

The Affordability of the Wellbeing Pension

If The Wellbeing Pension of £235 per week is paid by the UK Government, this would cost the UK Government £154 billion annually, which is still less than the UK Government’s £172 billion in revenues from NIC’s. The UK Government can easily afford the Wellbeing Pension, especially as it just raised National Insurance Contributions in April 2022 – just as it cut pensions in real terms.

The Wellbeing Pension will boost the economy

Raising the State Pension to the level of the Wellbeing Pension will do more than just improve the lives of low-income pensioners. Lifting people out of poverty is the best way to actually stimulate the economy.

When you raise the income of those in poverty, their spending increases, and most importantly they buy local goods and services. Pensioners raised out of poverty will buy clothes and food, heat their homes and frequent local establishments – so the extra money goes straight into the local economy and generates tax revenues. That in turn generates VAT on goods bought and more tax on the profits made by shops. As much as 20% of the additional cost of the Wellbeing Pension comes straight back to the Government in taxation from the economic boost it will give the economy.

As money circulates in the economy it generates profits and taxes and so, a better question is: Can we afford not to pay The Wellbeing Pension?

WE NEED TO PRIORITISE PENSIONER WELLBEING

HELP US send a message to the UK’s Pensions Minister by signing our petition stating loud and clear that pensioner poverty is unacceptable and that a Wellbeing Pension of £235 per week is required.

Sycamore House,

290 Bath Street,

3rd floor, Suite 1A,

Glasgow, G2 4JR